With Nigeria’s growing demand for financial assistance, online loan apps have become increasingly popular. In the past, getting a loan in Nigeria required extensive documentation and collateral, a significant hindrance for many Nigerians who needed financial assistance. Moreover, the emergence of online loan apps in Nigeria has made it easier for people to access loans without collateral or extensive documentation.

Online loan apps in Nigeria have revolutionized the way Nigerians access loans. They offer an easy and convenient way to access funds without traditional bank loans. Applying for loans on these apps is simple and can be done in minutes. Borrowers only need to download the app, register, and complete their profile to access loans within hours.

This article will discuss Nigeria’s top online loan apps and how to access loans. We will comprehensively review these apps, including their interest rates, repayment periods, and loan amounts. Also, we will provide valuable tips for borrowing responsibly and making the most of these online loan apps. By the end of this article, readers will clearly understand how online loan apps in Nigeria work and how they can benefit from them.

Top 5 Online Loan Apps in Nigeria Without Collateral

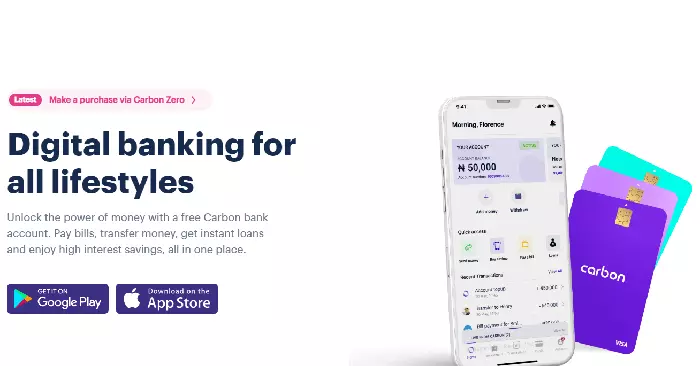

1. Carbon

Carbon is one of the most popular online loan apps in Nigeria. It was formerly known as Paylater and had over 2 million users. The app offers loans ranging from ₦1,500 to ₦1 million, with a repayment period of up to 12 months. The interest rate on Carbon loans ranges from 5% to 15.5% per month, depending on the loan amount and repayment period.

To access a loan on Carbon, download the app from the Google Play Store or Apple App Store, register, and complete your profile. You will be required to provide your BVN and bank account details. Once your profile is complete, you can apply for a loan and receive funds within a few hours.

2. Branch

Another popular and reliable online loan app in Nigeria is the Branch. It offers loans ranging from ₦1,000 to ₦200,000, with a reimbursement duration of up to 15 months. The interest rate on Branch loans ranges from 14% to 28% per month, depending on the loan amount and repayment period.

To access a loan on Branch, you can download the app from the Google Play Store or Apple App Store, register, and complete your profile. Once your profile is complete, you can apply for a loan and receive funds within a few hours.

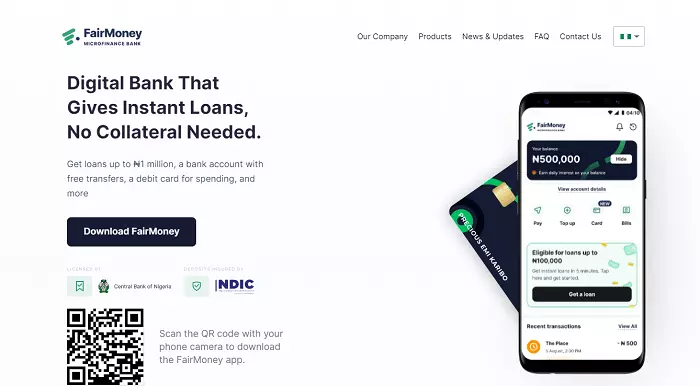

3. FairMoney

FairMoney is a relatively new online loan app in Nigeria. It offers loans ranging from ₦1,500 to ₦500,000, with a repayment period of up to 9 months. The interest rate on FairMoney loans ranges from 10% to 30% per month, depending on the loan amount and repayment period.

To access a loan on FairMoney, simply get the app from the Google Play Store or Apple App Store, register, and complete your profile. You will be required to provide your BVN and bank account details. After completing your profile, you can apply for a loan, and QuickCheck will disburse the funds within a few hours.

4. Renmoney

Renmoney is a leading online loan app in Nigeria. It offers loans ranging from ₦50,000 to ₦6 million, with a repayment period of up to 24 months. The interest rate on Renmoney loans ranges from 4% to 4.5% per month, depending on the loan amount and repayment period.

To access a loan on Renmoney, visit their website, register, and complete your profile. Their system requires you to provide your BVN and bank account details. when your profile is complete, you can apply for a loan and receive funds within a few hours.

Finally, online loan apps in Nigeria have made it easier for Nigerians to access loans without collateral or extensive documentation. Nigeria’s top online loan apps include Carbon, Branch, FairMoney, and Renmoney. To access loans on these apps, go to the app and download, register, and complete your profile. Remember to borrow responsibly and only take loans you can afford to repay.

5.QuickCheck

QuickCheck is one of Nigeria’s most famous online loan apps, with a user base of over 1 million. It offers loans up to ₦200 000 with a repayment period of up to 30 days. The interest rate on QuickCheck loans ranges from 5% to 30% per month, depending on the loan amount and repayment period.

To access a loan on QuickCheck, borrowers only need to download the app from the Google Play Store or Apple App Store, register, and complete their profile. The app uses advanced algorithms to evaluate borrowers’ creditworthiness, making loan decisions within minutes. If your loan application gets approval, QuickCheck will send funds within a few hours or the next day.

You Can Also Read: Online Loans In Ghana Without Collateral

One of the unique features of QuickCheck is its flexible repayment options. Borrowers can choose to repay their loans in multiple installments within the repayment period, making it easier to manage their finances. Further, QuickCheck offers loans without collateral or guarantors, making it a viable option for people who do not have traditional collateral or guarantors. Furthermore, QuickCheck is a reliable and convenient online loan app in Nigeria that offers flexible loans and quick disbursements.

Frequently Asked Questions (FAQs)

What is the quickest loan app in Nigeria?

Carbon, Branch, and Quick Check give out the quickest loan in Nigeria, but your credit score should be good. How much you can get will depend on your credit score and other factors. To get the assurance of getting an instant loan, maintain a good recognition score.

What is the best app to borrow money in Nigeria?

Nigerians consider Carbon and Branch the best loan app. Besides, reviews from professionals and borrowers rate the two loan apps high because of their competitive interest rates, and, considerably importantly, they have powerful investor backing with over $15 million.