As a taxpayer in the USA, filing tax returns correctly at an accurate time is very important. With the help of recent technology, you can now file your tax return online without stress. I am writing this article to help you with New Smart Tactics on How To Use Taxslayer To File Tax Returns in 2023.

A few weeks ago, I wrote an indebt article on this topic, and most of my readers need help understanding why there was no id.me verification process. Yes! The method was written for those who work with fullz. Now, in this tutorial, You will learn how to taxslayer to file a tax return with id.me for fast approval.

Requirement

- In other to file our refund correctly, we need to meet the IRS demand, which is:

- Social Security Number (SSN)

- Front and back of your Identification Card

- Current Address

- Text Now or Google Voice number

- Create a separate email with the SSN details

- Verified ID.me or whitehead for selfie verification

- Good IP

How To Get IRS Pin On ID.ME

After getting all the necessary documents ensure you set up your IP address correctly and follow the guide below to file it accurately.

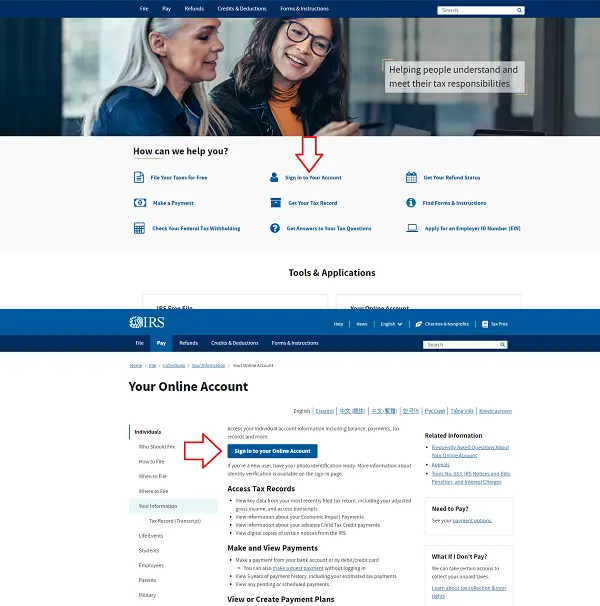

- Go to the IRS website, irs.gov, click Sign in to Your Account and tap Sign into your online account.

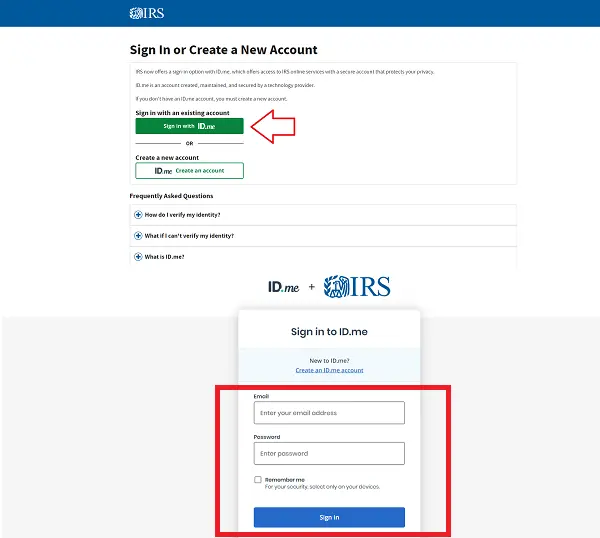

2. Sign in to your ID.me account and verify all the necessary 2fa. (A code will be sent to the owner; get the code and use it to verify)

3. Next, locate the Adjusted Gross Income by selecting Tax Records, and click on it to see the information.

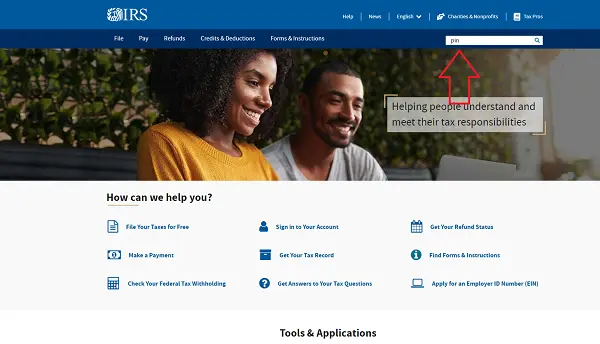

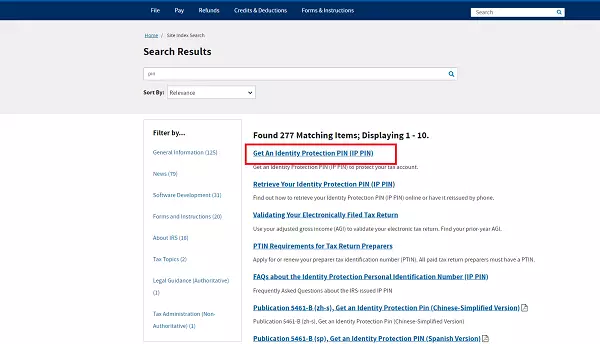

4. Click on Get An Identity Protection PIN (IP PIN)

5. Click on Get an IP PIN and click on Continue; your 6-digit number will be displayed

How To Use Taxlyer To File A Tax Return

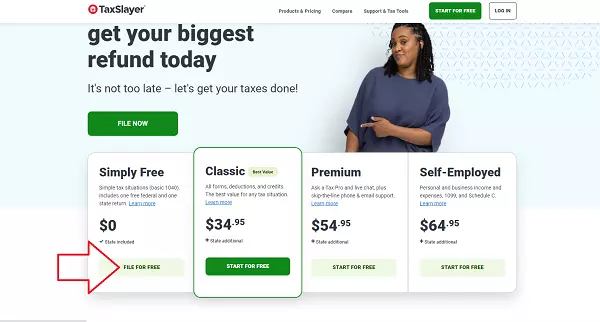

7. Go to TaxSlayer.com and click on the file for free button.

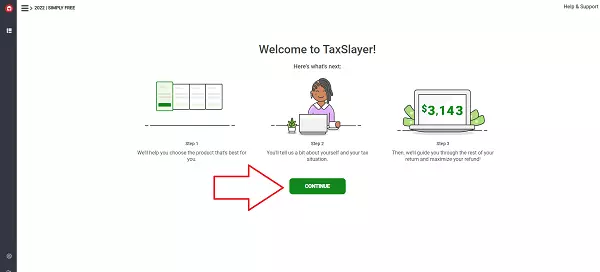

8. And click on the Continue Button.

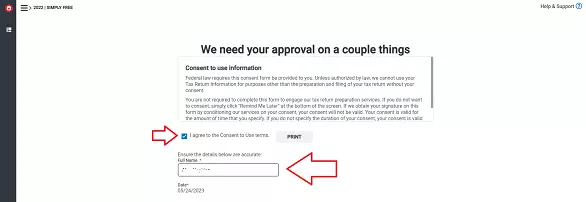

9. Next, check that I agree to the consent to use terms and enter the fullz name.

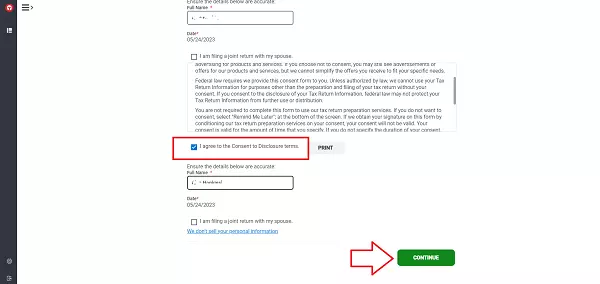

10. Do the same for this section and click on Continue.

11. Click on Continue with Simply Free

12. And then, click on Skip

13. Enter the owner details and click on continue.

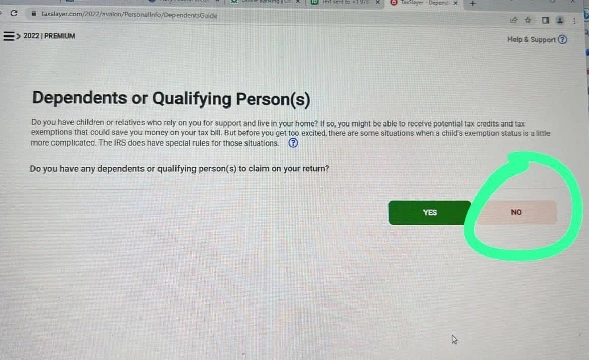

14. Dependent or Qualifying Person (s) Choose No

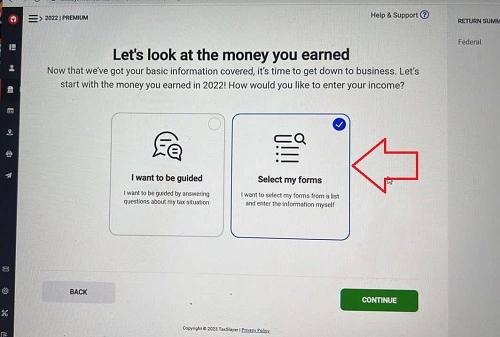

15. Choose “Select my form”; you can upload or enter it usually; I choose it Manually

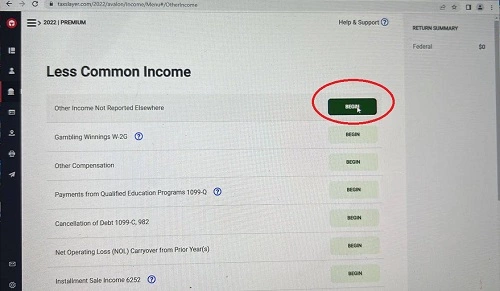

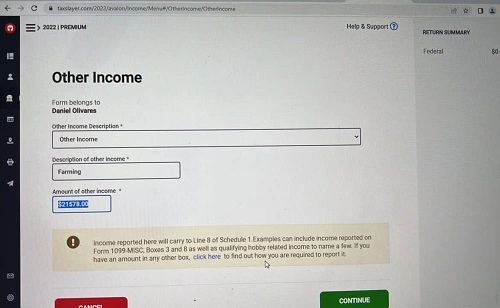

16. Other Income Reports Not Reported Elsewhere, Click on Begin.

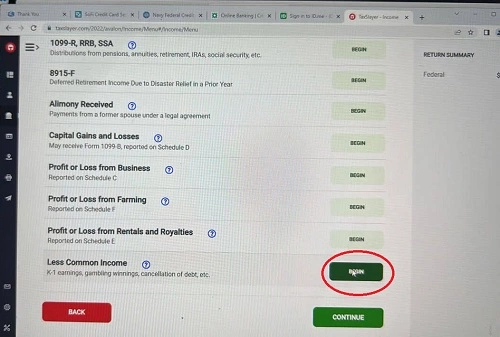

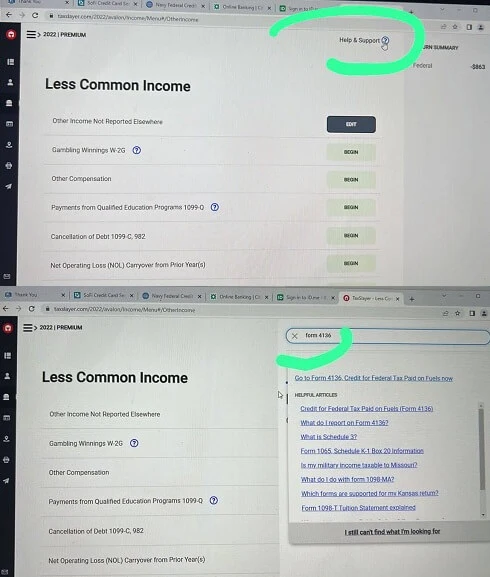

17. Now, tap on the Begin button near the Less Common Income

18. Enter $21578 as the amount of income

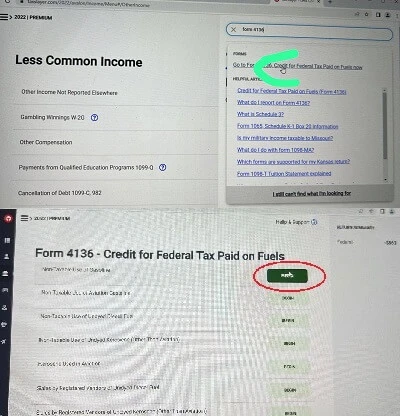

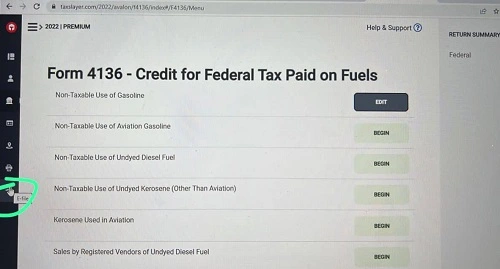

19. Click on the help & support and type form 4136 or any form you got under your AGI, and click on it.

20. Click on Begin and start editing

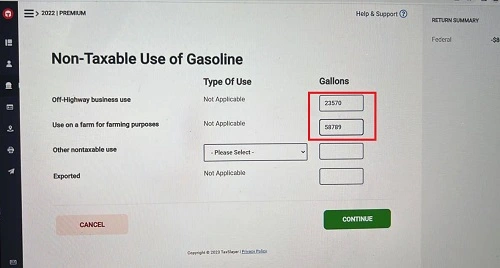

21. Enter the figures as seen in the below screenshot.

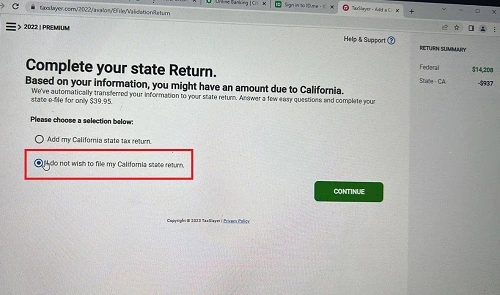

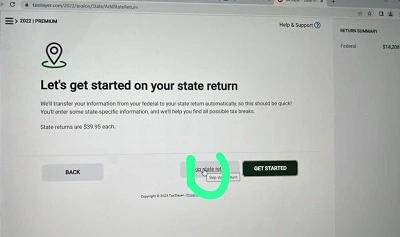

22. Choose I do not wish to file my state return

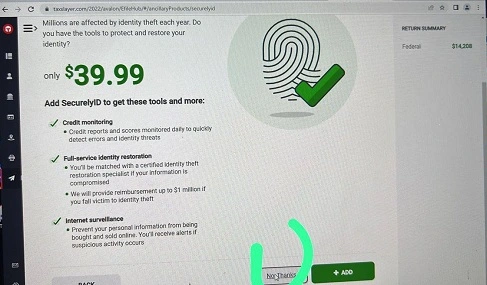

23. Tap on the No Thanks

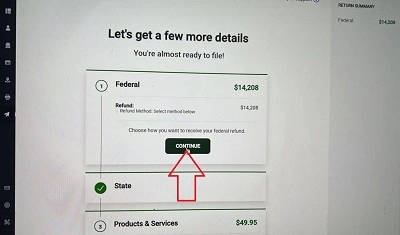

24. Click on E-file

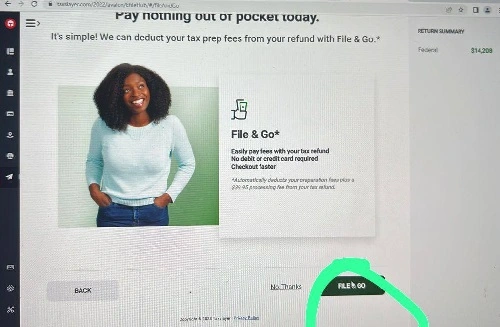

25. File and Go

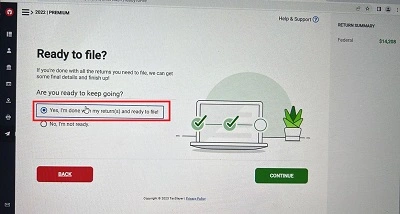

26 Check the Yes, I’m done with my returns button and click continue.

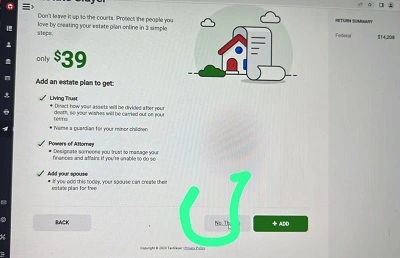

27. Use the No Thanks button

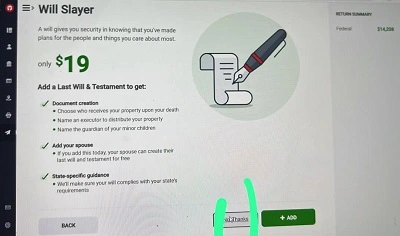

28. Do the same for this section

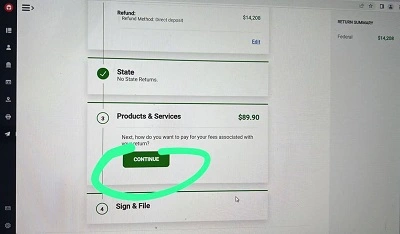

29. Click on Continue.

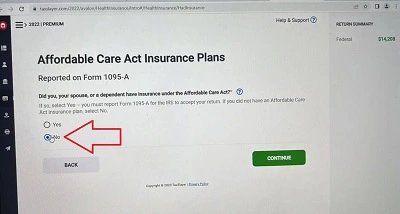

30. Choose “No” for the Affordable care act insurance

31. Tap on the No Thanks

32. And click on Continue.

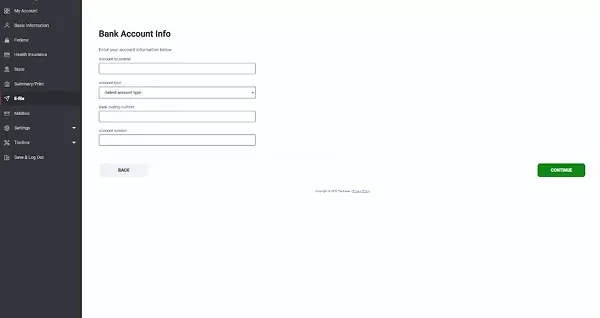

33. Enter the bank details you want to receive payment on and click on Continue, and that’s all.

Conclusion

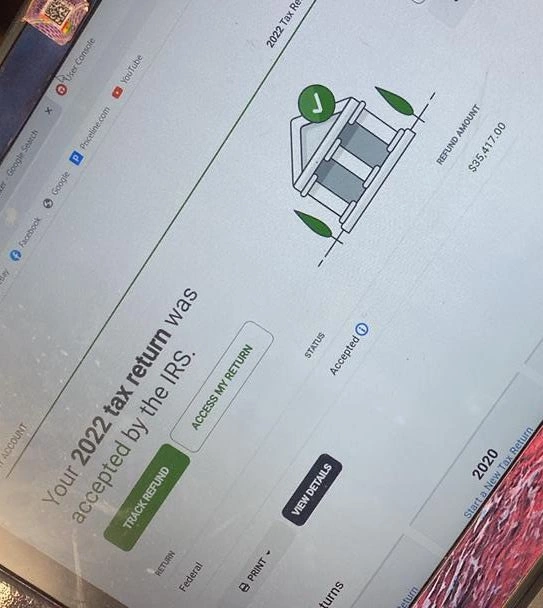

Finally, this comprehensive guide on how to use Taxslayer to e-file your returns without difficulties has been of help to you. If you don’t have an id.me or are using fullz, I recommend you use the previous method on regcollins. Let me have your feedback in the comment section if you face difficulties

Please the amounts on the Number 21 page is not well visible.

Sorry to hear that here are the figures

Off-Highway bussiness use = 23570

Use on a farm for farming purposese = 58789

Boss how do we file for extension for those of us that have been approved, as it’s ending soon.

Can I use any bank or must be name match

Yes it must match

Please I want to confirm we don’t need a w2 or 1099 forms to file this method here ?

Boss what is the diffrence between taxlayrer and Sbtpg tax refund

Form 4136 has been remove, how do we file to get high refund.Any solution to this?